Know How To Get VAT Refund In Italy, If It’s Possible

Knowing how to get VAT refund in Italy can be helpful because it is equivalent to sales tax in the U.S. and this guide will help you with the refund process.

What Is The Italian VAT?

A VAT (Value added tax) is equivalent to sales tax in the U.S. and it is the final cost paid by the private consumer, as opposed to a business. According to the Agenzia Entrate:

“It is a consumption tax that applies to the supply of goods and services carried out in Italy by entrepreneurs, professionals, or artists and on imports carried out by anyone.”

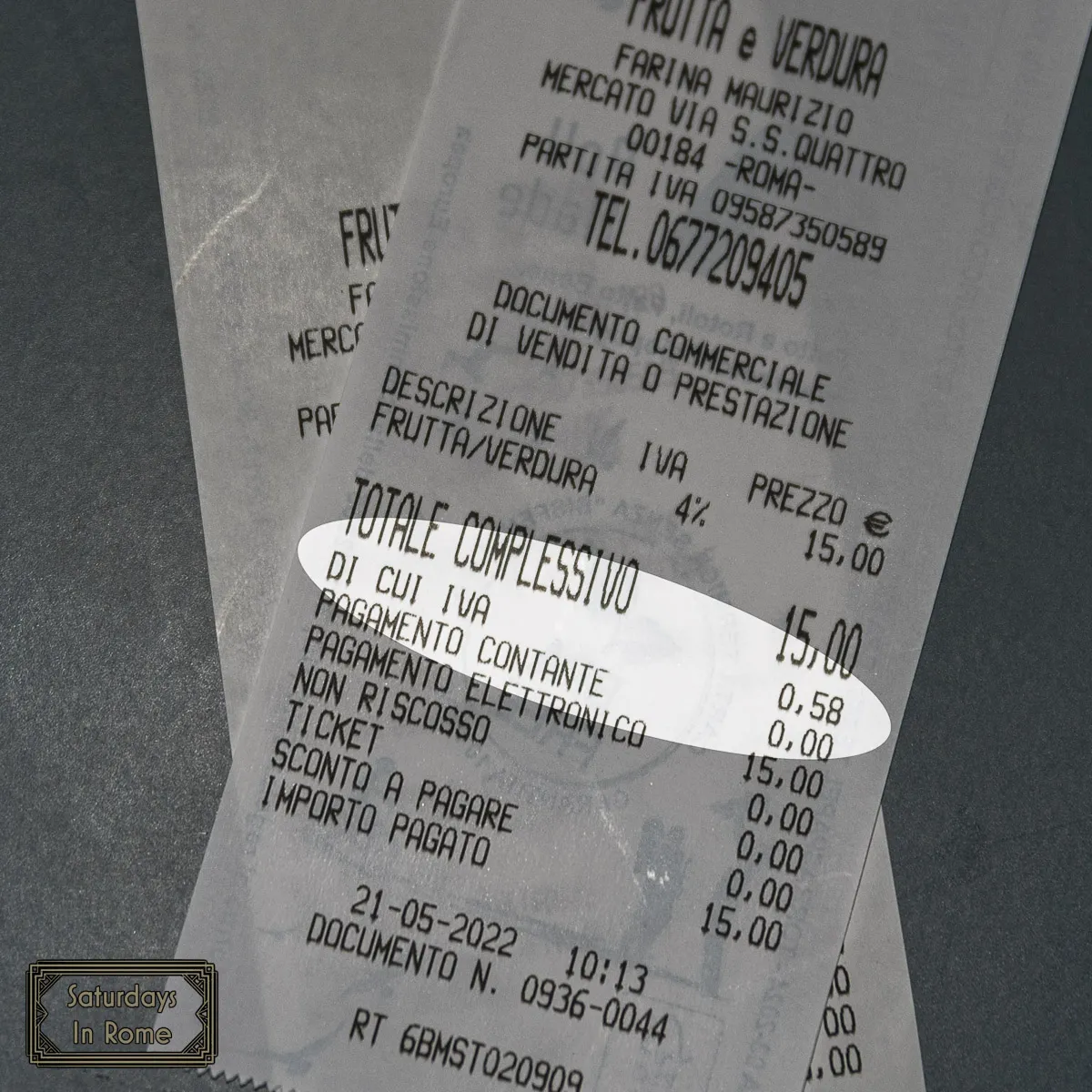

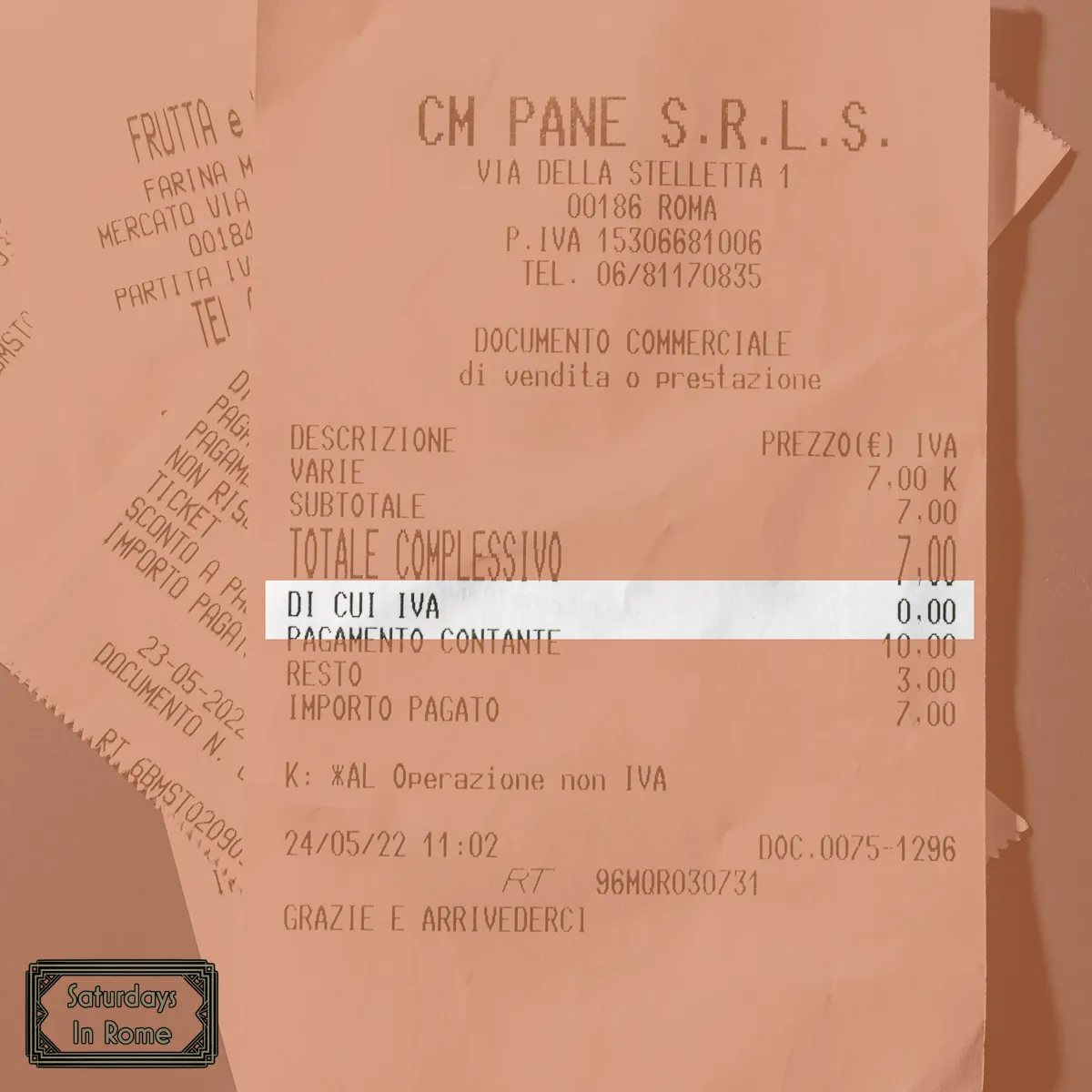

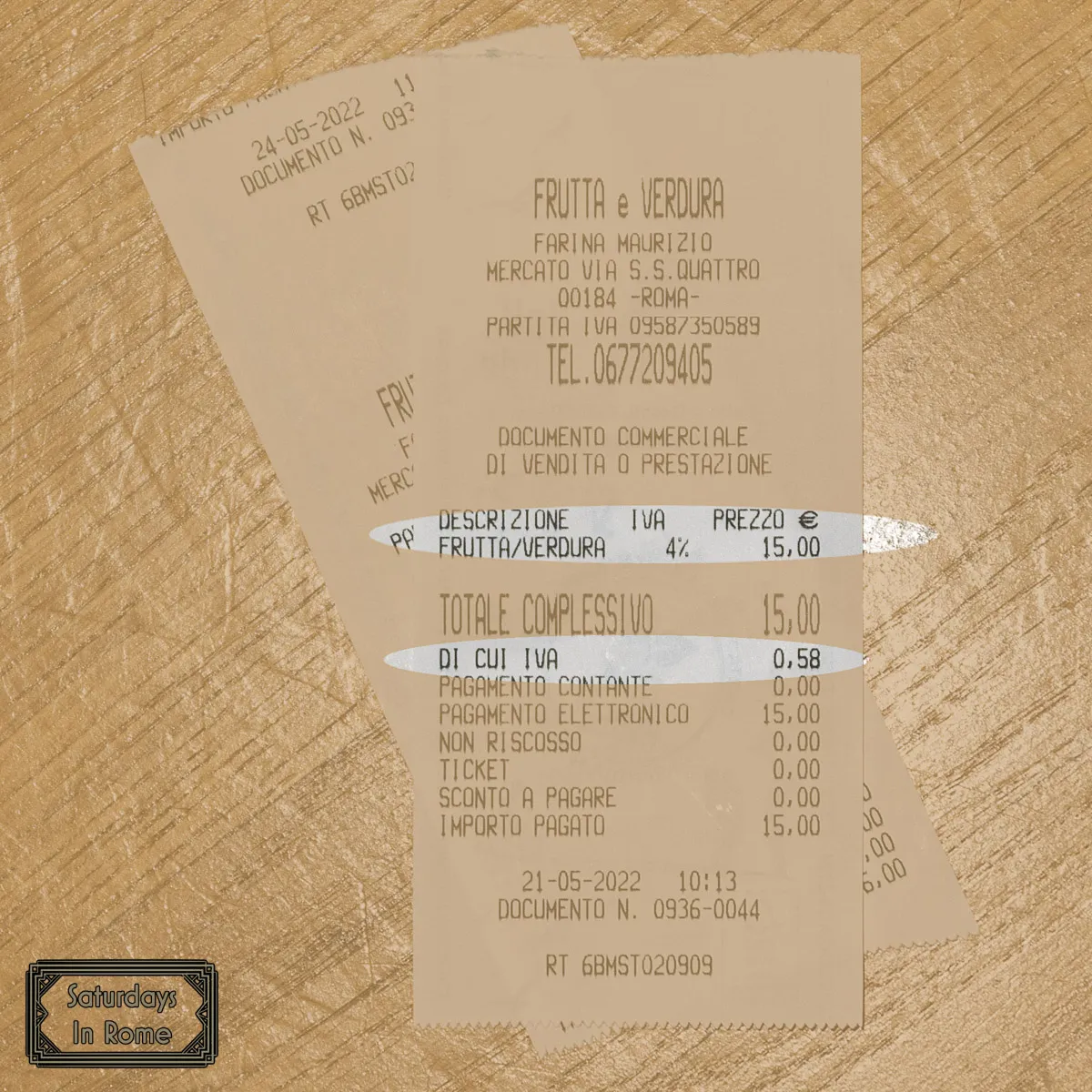

In Italy, the acronym IVA (Imposta sul Valore Aggiunto) is the same as the VAT and you will see it listed on every receipt.

Need Help Planning?

- Cheap Flights: Find The Most Affordable Flights.

- Accommodations: From 1 to 5 Stars And More.

- Car Rentals: Affordable Travel Across Italy.

- Sightseeing Tours: Explore Some Amazing Tours.

- Buying An eSIM: Stay Connected In Italy.

This post includes affiliate links.

Can US citizens Get VAT Back?

The short answer is: Yes, Americans can get a refund on the VAT they paid, but with a pile of limits and restrictions. The details on IF and HOW to get the refund are detailed below.

How Much VAT Do I Get Back In Italy?

In Italy the VAT rate is 22% but there are also reduced rates for several things, like 4% for listed food, drinks and agricultural products. Some goods and services are excluded, but typically are not of a concern to a traveler. For example: education, insurance services, specific financial services, supply, leasing of particular immovable property.

How it works is a VAT will be included in the price you pay for the goods you purchase. As a visitor to the EU who is returning home or going on to another non-EU country, you may be eligible to buy goods free of VAT in special shops.

Is There A Minimum Spend To Get A VAT Refund?

Surprisingly, here is some good news! Before January 31, 2024, the minimum purchase amount to be eligible for a VAT refund was €154.95, but this amount was decreased to €70.01. This change brought considerable opportunities for American tourists in Italy! So if you have an eligible purchase with a total price tag higher than 70 EUR, then you will easily claim back some of your investment before your departure from Italy.

What Items Qualify For VAT Refunds?

Even though when you think about Duty Free shops in the airport, alcohol, perfume and expensive chocolates are typically what comes to my mind, getting a VAT refund and Duty-free are not the same thing. The goods that qualify for a refund need to be new and unused.

Countries generally exempt exports from VAT, so if you buy merchandise as a tourist, what you take home is considered an export. Because of this, you are entitled to a refund for the VAT/IVA portion of the price.

What isn’t qualified for a refund are things that you buy in Italy and consume while you are here. For example, when you stay in a hotel or eat a restaurant meal, those services are consumed locally rather than exported. As such, you are not entitled to VAT refunds on those purchases.

You need to consider what type of traveler you are. If you come to Italy and your goal is to see the sites, eat delicious food and enjoy inexpensive wine, don’t worry about the VAT/IVA. The refund you might get for the couple of items you bought probably isn’t worth the effort. If, however, you came to Rome or Milan to buy expensive shoes and clothes, leather goods or art, then you definitely should care about the VAT/IVA you are paying. It’s probably worth the effort in this case.

How Can I Get VAT Refund In Italy?

If you are a visitor to Italy, or the EU in general and are about to leave the territory to go home or to some other place outside the EU, you may be able to buy goods free of VAT. If you are continuing your travels in the EU, you should wait until you are in the last countries you are visiting. Also, EU countries, including Italy, have a minimum threshold for claiming a refund, and that varies from country to country.

As I mentioned above, things that you consume while in Italy don’t qualify and can’t be claimed for a refund. Also, remember that San Marino and Vatican City are different countries, so anything purchased there wouldn’t qualify for an Italian refund.

An example: Beppe is an Italian citizen but lives permanently in the U.S. Once a year, he returns to Italy to feed his soul. Beppe is a ‘visitor’ and can apply for a refund on the basis of his U.S. Passport.

Is There A VAT Refund Claim Form?

This can be a pretty complicated process as I will describe below. Because of the complexity, there are companies that can provide you this service for a fee. If you are going to manage this process on your own, here is the best-case scenario:

- When you are in the shop, ask the assistant if they provide the tax-free service.

- At the check-out, the assistant will ask you to provide proof that you are a visitor and you will need to show your U.S. passport.

- You will need to fill in a form with the necessary details. You might be asked to show your ticket as proof you are leaving the EU within the required time.

- In some cases, the shop itself will refund the IVA (VAT) to you. In other cases, the shop will use a third-party to coordinate the refund.

- There will probably be an administrative fee. It is expected.

- You will receive an invoice (fattura) for the goods. You must show the invoice (fattura), the refund form, the goods and any other necessary documents to the customs officers when you leave. The customs officers must stamp the form as proof of export.

- You then follow the steps explained in your refund document or by the shop assistant.

Again, this process is assuming everything works well. If you want to outsource this process, for a fee, you can reach out to one of the tourism tax refund companies that can be found in the Rome airport. You can request the VAT refund form from one of the companies such as: Global Blue, Planet or Tax Refunds for Tourists.

Can I Get A VAT Refund From Italy Online?

Not if you are trying to claim the refund on your own. If you are using one of the companies I listed above, Global Blue, Planet or Tax Refunds for Tourists all have websites that will help you submit the documents and track your claim online. There are more complex procedures for businesses, but my focus is only with the pleasure traveler to Italy.

Ways To Earn A VAT Refund

Knowing how to get VAT refund in Italy is important if you earned it by spending a lot of money, and here are a few articles that I think will help:

- The Culture of Shopping in Rome: A Complete Visitors Guide.

- A Rome Shopping Mall Is A Great Experience For Tourists.

- The Best Shopping Mall Near The Fiumicino Airport In Rome.

- The “Made In Italy” Label Leads To Quality Italian Products.

- The Best Affordable Shopping In Rome Is Around Every Corner.

- Good Shopping In Rome – Answering Frequently Asked Questions.

- Rome’s Castel Romano Designer Outlet Is A Great Experience.

- Rome’s Train Station Shops Are Some Of The Best In Rome.

- Thrift Stores In Rome Are Great For Affordable Souvenirs

- The Christmas Market In Piazza Navona, Rome, Italy.

- Your Tipping In Rome Travel Guide For Americans In Italy.

- Cool Things To Buy In Rome That Can Be An Amazing Gift.